Launch Control System

SecureDAO has monitored and analyzed the performance of previous reserve currency protocols which have come and gone; these studies and first hand experience have been used to build a system of our own. Sustainability for our users is our number one goal. A key performance factor we have identified is the parameters of a launch, which can make or break a protocol.

Other reserve currency protocols find difficulty in managing their launch parameters and how these can affect the long-term performance of their treasury and reserves. We have seen many examples where protocols explode out of their launch with extended periods of heavy bonding and rebase rewards to the detriment of their users, who overtime have their investments heavily diluted.

We aim to avoid these long running issues by implementing a two-pronged Launch Control System (LCS). The system manages the SecureDAO launch parameters through Logarithmic Bonding Capacity (LBC) and Tapering Dividends.

Logarithmic Bonding Capacity

A major issue which we have identified in the launch of reserve currency protocols is the heavy dilution which occurs when a protocol decides to heavily increase their bonding capacity early into their lifecycle. This often leads to a cascading affect where the premium of the reserve currency is artificially capped due to large bonding debt and disincentives to stake (3, 3), effectively breaking the protocol.

To overcome this issue, we will be implementing a logarithmic bonding approach for a time period after launching the protocol.

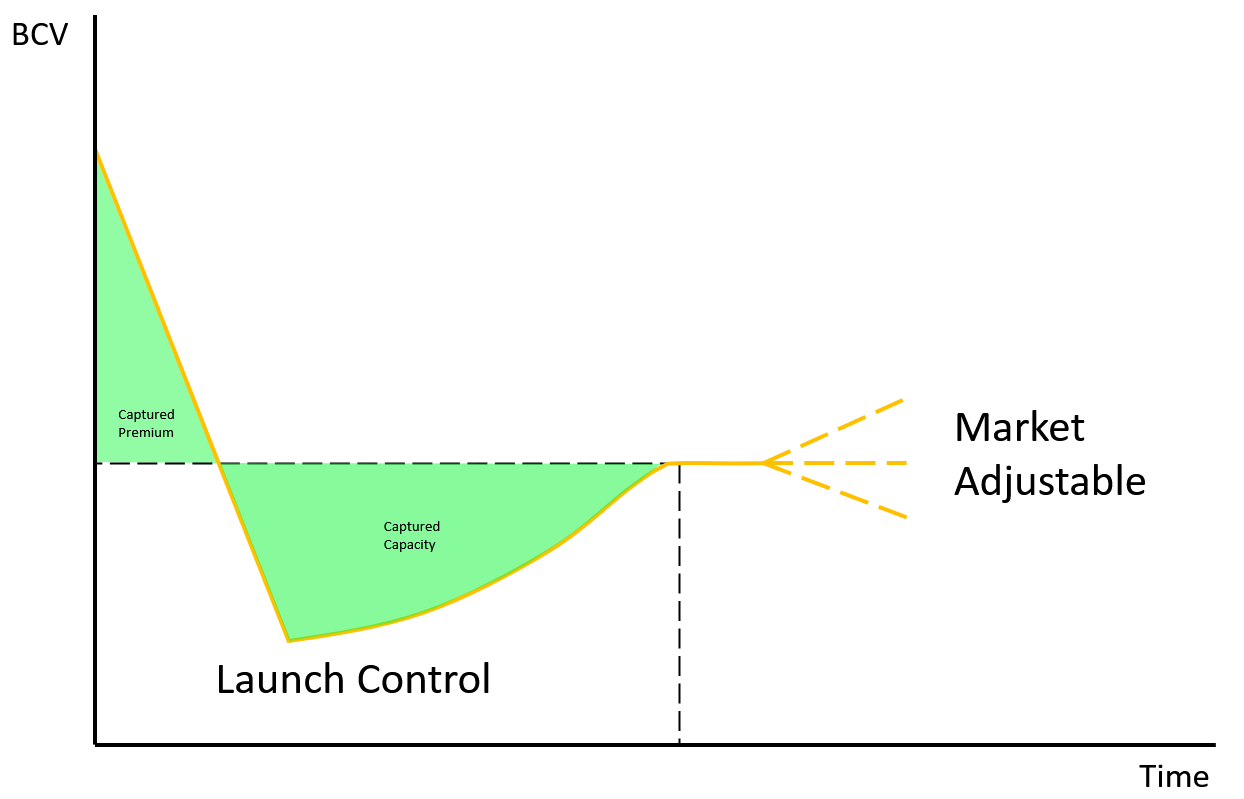

The LBC enables SecureDAO to both capture surplus premium during the launch period while also capturing a large proportion of extra bonding capacity before returning to an optimized bonding state catered for the sustainable growth of the protocol.

The LBC takes control of the bonding parameters of the protocol during the launch period of the protocol, initially slated for the first 5-day bonding window. Once the launch has been optimized the same logarithmic adjustment system will allow SecureDAO to adjust bonding to the market following an optimized method.

Tapering Dividends

Another visible weakness of previous reserve currency protocols is the mismanagement of rebase rewards, or dividends, which leads to out-of-control inflation of the reserve currency. This weakens the protocol going into the future.

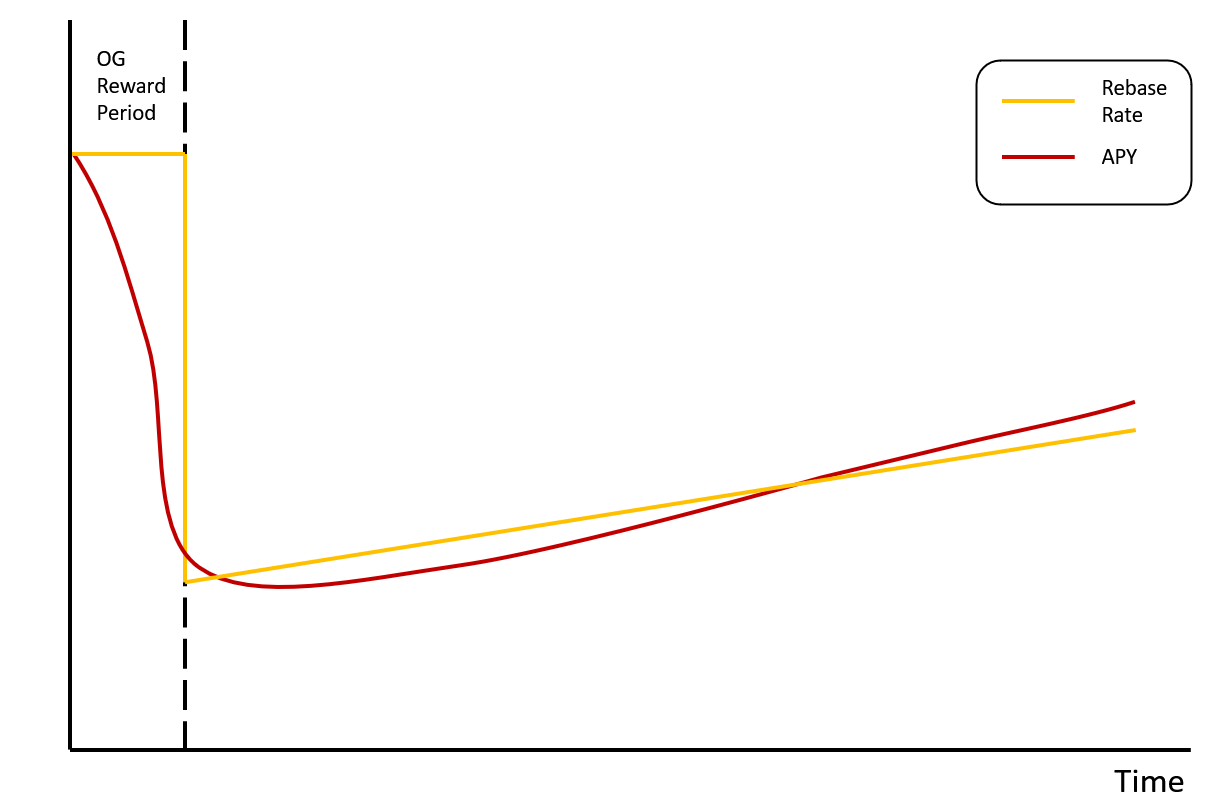

The introduction of Tapering Dividends aims to control this initial inflation by adjusting rebase rewards automatically overtime without sacrificing the rate-of-return for our users.

The rebase launch parameters for SecureDAO will include a time period of boosted rewards, much higher than any other protocol, which is intended to reward our early adopters and Secure Community who are those with the majority of supply able to participate in this event.

Following the reward period, the rebase rates will very quickly return to a normal period and begin to taper POSITIVELY. The intent here is to optimize periods which we expect to have lower staking rates where we are able to effectively reward our users while maintaining strong protocol health. Over the duration of the launch and early in the lifecycle of the protocol, the tapering acts as a consistent provider for staking demand, strengthening the (3, 3) aspect of the protocol.

Last updated