FAQ

Why do we need SecureDAO in the first place?

Dollar-pegged stablecoins have become an essential part of crypto due to their lack of volatility as compared to tokens such as Bitcoin and Ether. Users are comfortable with transacting using stablecoins knowing that they hold the same amount of purchasing power today vs. tomorrow. But this is a fallacy. The dollar is controlled by the US government and the Federal Reserve. This means a depreciation of dollar also means a depreciation of these stablecoins. SecureDAO aims to solve this by creating a non-pegged stablecoin called SCR. By focusing on supply growth rather than price appreciation, SecureDAO hopes that SCR can function as a currency that is able to hold its purchasing power regardless of market volatility.

Is SCR a stablecoin?

No, SCR is not a stablecoin. Rather, SCR aspires to become an algorithmic reserve currency backed by other decentralized assets. Similar to the idea of the gold standard, SCR provides free-floating value its users can always fall back on, simply because of the fractional treasury reserves SCR draws its intrinsic value from.

What is Magic Internet Money (MIM)?

Magic Internet Money (MIM) is a stablecoin backed by interest bearing tokens issued by abracadabra.money. MIM is native of the Ethereum Ecosystem and bridged to Fantom! The MIM address on Fantom is 0x82f0b8b456c1a451378467398982d4834b6829c1. Find out more about MIM here.

SCR is backed, not pegged.

Each SCR is backed by 1 MIM, not pegged to it. Because the treasury backs every SCR with at least 1 MIM, the protocol would buy back and burn SCR when it trades below 1 MIM. This has the effect of pushing SCR price back up to 1 MIM. SCR could always trade above 1 MIM because there is no upper limit imposed by the protocol. Think pegged == 1, while backed >= 1.You might say that the SCR floor price or intrinsic value is 1 MIM. We believe that the actual price will always be 1 MIM + premium, but in the end that is up to the market to decide.

How does it work?

At a high level, SecureDAO consists of its protocol managed treasury, protocol owned liquidity, bond mechanism (minting), and high staking rewards that are designed to control supply expansion. Bonding in the "Mint" page generates profit for the protocol, and the treasury uses the profit to mint SCR and distribute them to stakers. With LP bond, the protocol is able to accumulate liquidity to ensure the system stability.

What is the deal with (3,3) and (1,1)?

(3,3) is the idea that, if everyone cooperated in SecureDAO, it would generate the greatest gain for everyone (from a game theory standpoint). Currently, there are three actions a user can take:

Staking (+2)

Bonding (+1)

Selling (-2)

Staking and bonding are considered beneficial to the protocol, while selling is considered detrimental. Staking and selling will also cause a price move, while bonding does not (we consider buying SCR from the market as a prerequisite of staking, thus causing a price move). If both actions are beneficial, the actor who moves price also gets half of the benefit (+1). If both actions are contradictory, the bad actor who moves price gets half of the benefit (+1), while the good actor who moves price gets half of the downside (-1). If both actions are detrimental, which implies both actors are selling, they both get half of the downside (-1).Thus, given two actors, all scenarios of what they could do and the effect on the protocol are shown here:

If we both stake (3, 3), it is the best thing for both of us and the protocol (3 + 3 = 6).

If one of us stakes and the other one bonds, it is also great because staking takes SCR off the market and put it into the protocol, while bonding provides liquidity and MIM for the treasury (3 + 1 = 4).

When one of us sells, it diminishes effort of the other one who stakes or bonds (1 - 1 = 0).

When we both sell, it creates the worst outcome for both of us and the protocol (-3 - 3 = -6).

Why is PCV important?

As the protocol controls the funds in its treasury, SCR can only be minted or burned by the protocol. This also guarantees that the protocol can always back 1 SCR with 1 MIM. You can easily define the risk of your investment because you can be confident that the protocol will indefinitely buy SCR below 1 MIM with the treasury assets until no one is left to sell. You can't trust the FED but you can trust the code. As the protocol accumulates more PCV, more runway is guaranteed for the stakers. This means the stakers can be confident that the current staking APY can be sustained for a longer term because more funds are available in the treasury.

Why is the market price of SCR so volatile?

It is extremely important to understand how early in development the SecureDAO protocol is. A large amount of discussion has centered around the current price and expected a stable value moving forward. The reality is that these characteristics are not yet determined. The network is currently tuned for expansion of SCR supply, which when paired with the staking, minting, and yield mechanics of SecureDAO, result in a fair amount of volatility. SCR could trade at a very high price because the market is ready to pay a hefty premium to capture a percentage of the current market capitalization. However, the price of SCR could also drop to a large degree if the market sentiment turns bearish. We would expect significant price volatility during our growth phase so please do your own research whether this project suits your goals.

What is the point of buying it now when SCR trades at a very high premium?

When you buy and stake SCR, you capture a percentage of the supply (market cap) which will remain close to a constant. This is because your staked SCR balance also increases along with the circulating supply. The implication is that if you buy SCR when the market cap is low, you would be capturing a larger percentage of the market cap.

What is a rebase?

Rebase is a mechanism by which your staked SCR balance increases automatically. When new SCR are minted by the protocol, a large portion of it goes to the stakers. Because stakers only see staked SCR balance instead of SCR the protocol utilizes the rebase mechanism to increase the staked SCR balance so that 1 staked SCR (sSCR) is always redeemable for 1 SCR.

What is reward yield?

Reward yield is the percentage by which your staked SCR balance increases on the next epoch. It is also known as rebase rate. You can find this number on the SecureDAO staking page.

What is APY?

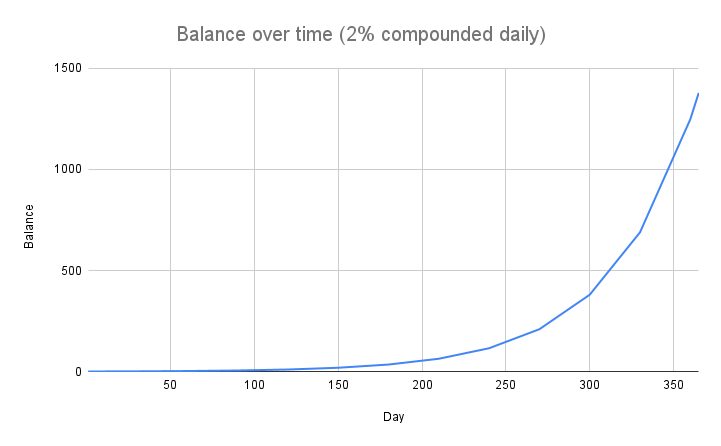

APY stands for annual percentage yield. It measures the real rate of return on your principal by taking into account the effect of compounding interest. In the case of SecureDAO, your staked SCR represents your principal, and the compound interest is added periodically on every epoch (8 hours) thanks to the rebase mechanism.One interesting fact about APY is that your balance will grow not linearly but exponentially over time! Assuming a daily compound interest of 2%, if you start with a balance of 1 SCR on day 1, after a year, your balance will grow to about 1377.

Last updated